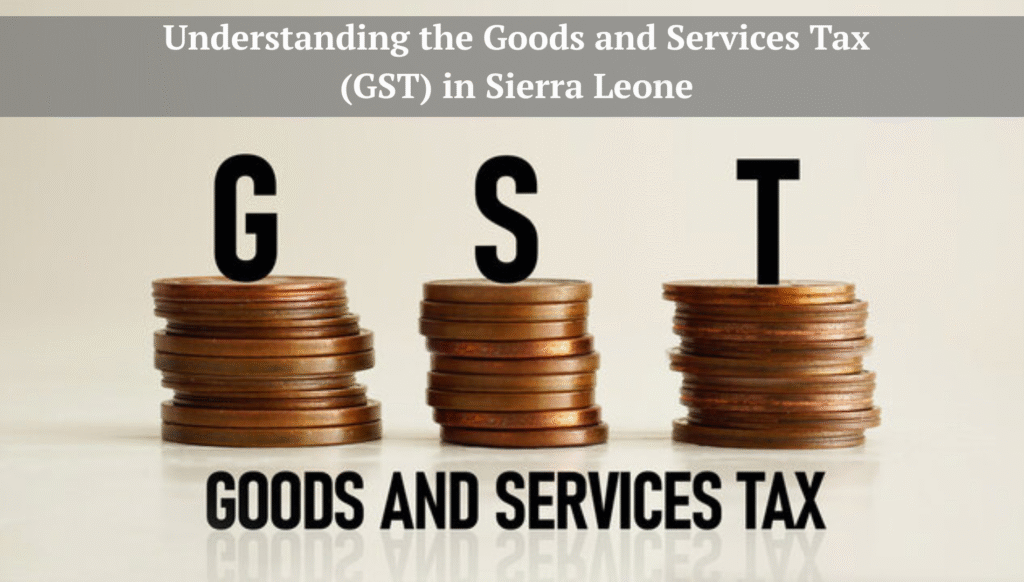

Understanding the Goods and Services Tax (GST) in Sierra Leone

1.1 Introduction to the GST System

The Goods and Services Tax (GST) is a value-added tax (VAT) introduced in Sierra Leone under the Goods and Services Tax Act, 2009. It is administered by the National Revenue Authority (NRA) and was established to simplify the taxation system by replacing multiple sales tax structures.

GST applies to most goods and services supplied within Sierra Leone, with the tax ultimately borne by the final consumer.

The GST system consists of three main categories:

- Standard Rate (15%) – A 15% Goods and Services Tax (GST) is applied to the invoiced amount for all taxable goods and services.

- Zero-Rated Supplies (0%) – A 0% Goods and Services Tax (GST) is applied to certain goods and services, such as:

- Exported goods.

- Goods supplied as stores on vessels and aircraft leaving Sierra Leone.

- Exempt Supplies – These goods and services are outside the scope of GST. Businesses selling only exempt goods or services are not required to register for GST and do not charge GST on invoices. Some examples of exempt supplies include:

- Unprocessed rice.

- Agricultural inputs.

- Water, books, and newspapers.

- Medical services and pharmaceuticals.

- Educational services.

- Machinery, plant, and equipment designed exclusively for agriculture, manufacturing, and mining.

1.2 GST Registration

A business must register for Goods and Services Tax (GST) if its annual taxable turnover exceeds NLe 500,000. Registration must be completed by the end of the month following the month in which the threshold is exceeded.

Example 1:

A.A enterprise began trading on 1 June 2025, with the following taxable sales:

- 12 June 2025 – NLe 150,000

- 14 July 2025 – NLe 200,000

- 18 August 2025 – NLe 300,000

- 20 September 2025 – NLe 250,000

Analysis:

A.A enterprise exceeded the GST registration threshold (NLe 500,000) on 18 August 2025, when cumulative sales reached NLe 650,000. The business must apply for GST registration by 30 September 2025, and registration will take effect on 1 October 2025.

A business may also voluntarily register for Goods and Services Tax (GST) if it engages in taxable activities and intends to make taxable supplies.

1.3 Filing GST Returns & Payments

A supply of goods or services is considered made at the earlier of the following events:

- a) An invoice is issued by the supplier.

- b) Payment is received for the supply.

- c) Goods are delivered or made available for collection.

- d) Services are performed (for service-based transactions).

All Goods and services tax (GST) transactions within a given month must be reported to the NRA within 21 days after the end of the month.

Example 2:

A.A Enterprises recorded the following transactions in March 2025:

- 2 March: Purchased goods for NLe 320,000 (excluding GST)

- 5 March: Sold goods for NLe 300,000 (excluding GST)

- 6 March: Bought office stationery for NLe 20,000 (excluding GST)

- 10 March: Sold goods for NLe 250,000 (including GST)

- 15 March: Paid accountancy fees of NLe 30,000 (including GST)

- 20 March: Sold goods for NLe 200,000 (excluding GST)

- 28 March: Bought goods for NLe 330,000 (including GST)

- 31 March: Sold goods for NLe 280,000 (including GST)

The GST return for March 2025 will be filed on of before the 21st April 2025 using the NRA’s ITAS system, and the required payment be made at the bank after generating a payment reference number.

1.4 Penal Provisions

Failure to file GST returns within 21 days and pay GST within 30 days after the end of the tax month result in penalties:

Penalty Type | Large Taxpayer | Medium Taxpayer | Small Taxpayer |

Late Filing | 5,000.00 | 2,500.00 | 500.00 |

Non-Filing | 10,000.00 | 5,000.00 | 1,000.00 |

Additional penalties apply for:

- Failure to pay GST on time – Interest is charged at the Bank of Sierra Leone lending rate until payment is made.

- Failure to register for GST – Penalties range from 10% to 100% of unpaid GST.

- Failure to display a GST Registration Certificate – Fine of NLe 5,000, increasing daily after a written notice is issued.

- Failure to notify the NRA of business changes – Fine of NLe 5,000 for non-compliance.

1.5 Frequently Asked Questions (FAQs)

- What is the GST registration threshold?

- Businesses with an annual turnover of NLe 500,000 must register for GST.

- What happens if I fail to register for GST?

- The NRA may impose penalties ranging from 10% to 100% of unpaid GST.

- Can I claim input tax credits?

- Yes, businesses can claim GST credits for eligible purchases.

- Which goods and services are exempt from GST?

- Exempt items include basic food, medical supplies, and educational materials.

- How do I file GST returns?

- Returns must be filed monthly via the NRA ITAS portal.

- What are the penalties for late or non-filing?

- Late filing: NLe 500 – NLe 5,000

- Non-filing: NLe 1,000 – NLe 10,000

- Are exports subject to GST?

- No, exports are zero-rated (0%).

- How long do I have to register after exceeding the threshold?

- Within 30 days after the end of the month of meeting the threshold.

- Is a Tax Identification Number (TIN) required for GST registration?

- Yes, a TIN is mandatory before registering for GST.

How Gordon & Associates Can Help

We provide expert GST advisory services, including:

- GST registration assistance

- Monthly return filing support

- Guidance on input tax credit claims

- Compliance management & advisory

Contact Gordon & Associates today on info@gordonassociates-sl.com for expert support in navigating Sierra Leone’s GST system.